Life Insurance Corporation of India (LIC) is one of the most trusted and popular insurance providers in India. To make managing policies easier for its customers, LIC offers an online portal where you can access a range of services from the comfort of your home. If you are wondering, “How can I register my LIC policy portal?”, this comprehensive guide will walk you through the steps, benefits, and other important details.

Why Register on the LIC Policy Portal?

Registering on the LIC policy portal brings a host of benefits:

- Access Policy Details: View your policy status, premium due dates, and policy conditions instantly.

- Online Payments: Pay premiums online without visiting a branch.

- Download Policy Documents: Get copies of your policy bonds, receipts, and other important documents.

- Loan and Claim Tracking: Apply for loans against your policy or track your claim status.

- Customer Support: Raise service requests or queries directly through the portal.

How Can I Register My LIC Policy Portal?

Registering your LIC policy online is a straightforward process. Follow these steps to create your account:

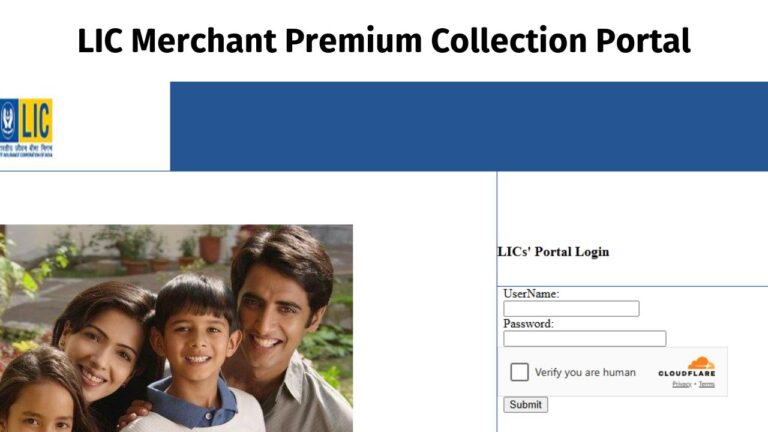

Step 1: Visit the Official LIC Website

Go to the official LIC website at www.licindia.in. The portal is user-friendly and provides all the necessary tools for policy management.

Step 2: Click on “Customer Portal”

On the homepage, locate the “Customer Portal” option and click on it. This will redirect you to the registration page.

Step 3: Select “New User”

If you are registering for the first time, click on the “New User” button. Existing users can simply log in with their credentials.

Step 4: Enter Your Details

Fill in the following details to create your account:

- Policy Number: Enter the number of the LIC policy you wish to register.

- Date of Birth: Provide your date of birth as per your policy document.

- Mobile Number: Enter your active mobile number for communication.

- Email ID: Provide a valid email address.

Step 5: Create a Username and Password

Create a unique username and password to secure your account. Make sure your password is strong and memorable.

Step 6: Submit the Form

Once all the details are filled in, click on “Submit” to complete the registration process. You will receive an email or SMS confirming your registration.

Step 7: Login and Add Policies

After registering, log in to your account and add all your LIC policies by entering their respective policy numbers. This will help you manage multiple policies in one place.

Benefits of Registering Multiple Policies

If you own multiple LIC policies, registering them on the portal allows you to:

- Consolidate premium payments.

- Track the performance of all policies.

- Receive timely reminders for premium due dates.

Features Available on the LIC Policy Portal

- Premium Calculator: Calculate premiums for new policies before purchasing.

- Policy Renewal: Renew lapsed policies online.

- Premium Payment History: View and download the payment history.

- Loan Against Policy: Apply for loans against eligible policies.

- Nominee Updates: Update or change nominee details.

Troubleshooting Registration Issues

If you encounter issues while registering, here are some solutions:

- Incorrect Policy Number: Double-check your policy number and re-enter it.

- Mobile or Email Errors: Ensure the mobile number and email ID match the details in your policy records.

- Password Issues: If you forget your password, use the “Forgot Password” option to reset it.

- Technical Errors: Clear your browser cache or try using a different browser.

Important Tips for a Seamless Experience

- Keep Documents Handy: Have your policy bond, ID proof, and contact details ready.

- Use Secure Internet: Avoid public Wi-Fi for registration and payments.

- Check Updates Regularly: Log in periodically to stay updated on policy changes.

- Enable Notifications: Opt for SMS or email alerts to receive reminders and updates.

Frequently Asked Questions (FAQs)

Q1: Is it mandatory to register my LIC policy online?

No, it is not mandatory, but it is highly recommended for easy management of your policies and access to online services.

Q2: How many policies can I register on the portal?

You can register multiple policies under one account as long as you are the policyholder.

Q3: Can I register my family members’ policies?

Yes, you can register your family members’ policies if you are an appointee or guardian, provided you have their consent.

Q4: What should I do if I forget my password?

Use the “Forgot Password” option on the login page to reset your password. You’ll need to provide your registered email ID or mobile number.

Q5: Is the LIC portal safe for online transactions?

Yes, the LIC portal uses secure encryption technology to protect your personal and financial data.

Q6: How can I update my contact details on the portal?

Log in to your account, navigate to the profile section, and update your mobile number or email ID.

Q7: What if I face issues during registration?

If you face any issues, contact LIC’s customer care or visit the nearest branch for assistance.

Conclusion

Registering your LIC policy on the official portal is an easy and efficient way to manage your insurance policies. By following the steps outlined in this guide, you can access a wide range of services, save time, and stay on top of your policy details. Whether it’s paying premiums, downloading documents, or applying for loans, the LIC policy portal simplifies your insurance experience. So, if you’re asking yourself, “How can I register my LIC policy portal?”, start today and enjoy hassle-free policy management!